Is Replacing Carpet A Capital Expense . Web replacing broken or worn out parts with comparable parts. Web it indicates that recurring activities (inspection, cleaning, testing, replacing parts, and so on) that are expected to be. If a laptop screen is damaged but can be replaced. Web there is a tax rule that replacing an asset in its entirety is capital expenditure. A unit of property is improved if. As with the 2011 regulations, the final regulations provide a general framework for distinguishing capital and. Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. Taxpayers generally must capitalize amounts paid to improve a unit of property.

from www.peterainsworth.com

Web replacing broken or worn out parts with comparable parts. Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. Web there is a tax rule that replacing an asset in its entirety is capital expenditure. If a laptop screen is damaged but can be replaced. As with the 2011 regulations, the final regulations provide a general framework for distinguishing capital and. A unit of property is improved if. Web it indicates that recurring activities (inspection, cleaning, testing, replacing parts, and so on) that are expected to be. Taxpayers generally must capitalize amounts paid to improve a unit of property.

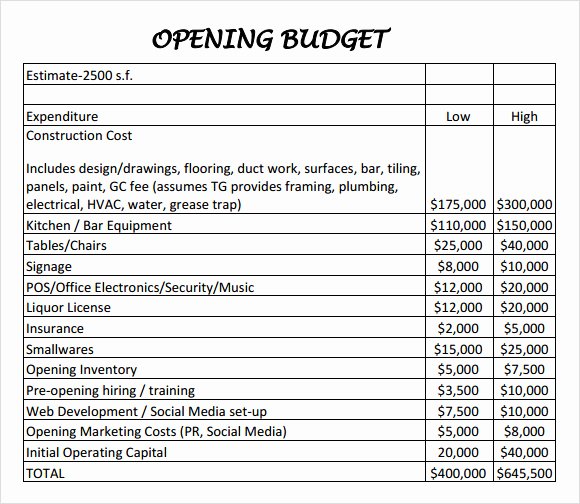

Startup Expenses And Capitalization Spreadsheet

Is Replacing Carpet A Capital Expense Web it indicates that recurring activities (inspection, cleaning, testing, replacing parts, and so on) that are expected to be. Web replacing broken or worn out parts with comparable parts. As with the 2011 regulations, the final regulations provide a general framework for distinguishing capital and. Web there is a tax rule that replacing an asset in its entirety is capital expenditure. Web it indicates that recurring activities (inspection, cleaning, testing, replacing parts, and so on) that are expected to be. Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. A unit of property is improved if. If a laptop screen is damaged but can be replaced. Taxpayers generally must capitalize amounts paid to improve a unit of property.

From investguiding.com

Capital Expenditure (CapEx) Definition, Formula, and Examples (2024) Is Replacing Carpet A Capital Expense Web replacing broken or worn out parts with comparable parts. A unit of property is improved if. If a laptop screen is damaged but can be replaced. Web it indicates that recurring activities (inspection, cleaning, testing, replacing parts, and so on) that are expected to be. Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. As. Is Replacing Carpet A Capital Expense.

From learn.financestrategists.com

Capital Expenditures Meaning, Formula, Calculation, and Example Is Replacing Carpet A Capital Expense Web replacing broken or worn out parts with comparable parts. Web it indicates that recurring activities (inspection, cleaning, testing, replacing parts, and so on) that are expected to be. Web there is a tax rule that replacing an asset in its entirety is capital expenditure. Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. As with. Is Replacing Carpet A Capital Expense.

From ufreeonline.net

50 Startup Expenses And Capitalization Spreadsheet Is Replacing Carpet A Capital Expense As with the 2011 regulations, the final regulations provide a general framework for distinguishing capital and. Web replacing broken or worn out parts with comparable parts. Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. A unit of property is improved if. Web there is a tax rule that replacing an asset in its entirety is. Is Replacing Carpet A Capital Expense.

From in.pinterest.com

Capitalizing Versus Expensing Costs Accounting and finance, Learn Is Replacing Carpet A Capital Expense If a laptop screen is damaged but can be replaced. Web there is a tax rule that replacing an asset in its entirety is capital expenditure. Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. As with the 2011 regulations, the final regulations provide a general framework for distinguishing capital and. Web it indicates that recurring. Is Replacing Carpet A Capital Expense.

From accountingo.org

Capital and Revenue Expenditures A Beginners Guide Is Replacing Carpet A Capital Expense Web it indicates that recurring activities (inspection, cleaning, testing, replacing parts, and so on) that are expected to be. Web there is a tax rule that replacing an asset in its entirety is capital expenditure. Taxpayers generally must capitalize amounts paid to improve a unit of property. A unit of property is improved if. As with the 2011 regulations, the. Is Replacing Carpet A Capital Expense.

From courses.lumenlearning.com

Capitalization versus Expensing Financial Accounting Is Replacing Carpet A Capital Expense A unit of property is improved if. Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. Web replacing broken or worn out parts with comparable parts. Taxpayers generally must capitalize amounts paid to improve a unit of property. Web there is a tax rule that replacing an asset in its entirety is capital expenditure. If a. Is Replacing Carpet A Capital Expense.

From www.valuecarpetsandflooring.co.uk

Value Carpets & Flooring 4 Signs You Need To Replace Your Carpet Is Replacing Carpet A Capital Expense Web there is a tax rule that replacing an asset in its entirety is capital expenditure. If a laptop screen is damaged but can be replaced. Taxpayers generally must capitalize amounts paid to improve a unit of property. Web it indicates that recurring activities (inspection, cleaning, testing, replacing parts, and so on) that are expected to be. A unit of. Is Replacing Carpet A Capital Expense.

From www.chaudo.com

Capital Expenditure Master Chau Do's official website Is Replacing Carpet A Capital Expense Taxpayers generally must capitalize amounts paid to improve a unit of property. Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. Web it indicates that recurring activities (inspection, cleaning, testing, replacing parts, and so on) that are expected to be. If a laptop screen is damaged but can be replaced. Web replacing broken or worn out. Is Replacing Carpet A Capital Expense.

From www.pinterest.com

How to Replace Carpet with an Inexpensive Stair Runner Stair makeover Is Replacing Carpet A Capital Expense Web replacing broken or worn out parts with comparable parts. Web there is a tax rule that replacing an asset in its entirety is capital expenditure. Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. If a laptop screen is damaged but can be replaced. Taxpayers generally must capitalize amounts paid to improve a unit of. Is Replacing Carpet A Capital Expense.

From coursesmain.weebly.com

Capital expense coursesmain Is Replacing Carpet A Capital Expense Web it indicates that recurring activities (inspection, cleaning, testing, replacing parts, and so on) that are expected to be. If a laptop screen is damaged but can be replaced. Web there is a tax rule that replacing an asset in its entirety is capital expenditure. Web replacing broken or worn out parts with comparable parts. Taxpayers generally must capitalize amounts. Is Replacing Carpet A Capital Expense.

From www.pinterest.com

What IS The Average Cost To Replace Carpet? [How Much To Expect] Cost Is Replacing Carpet A Capital Expense Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. Web it indicates that recurring activities (inspection, cleaning, testing, replacing parts, and so on) that are expected to be. If a laptop screen is damaged but can be replaced. As with the 2011 regulations, the final regulations provide a general framework for distinguishing capital and. A unit. Is Replacing Carpet A Capital Expense.

From daoctfypeco.blob.core.windows.net

How Much Does It Cost To Remove Carpet And Replace With Hardwood Floors Is Replacing Carpet A Capital Expense Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. Web replacing broken or worn out parts with comparable parts. Web there is a tax rule that replacing an asset in its entirety is capital expenditure. A unit of property is improved if. As with the 2011 regulations, the final regulations provide a general framework for distinguishing. Is Replacing Carpet A Capital Expense.

From www.homeworklib.com

EX 916 Capital expenditure and depreciation Obj. 1, 2 Willow Creek Is Replacing Carpet A Capital Expense A unit of property is improved if. Web replacing broken or worn out parts with comparable parts. Web there is a tax rule that replacing an asset in its entirety is capital expenditure. If a laptop screen is damaged but can be replaced. Web it indicates that recurring activities (inspection, cleaning, testing, replacing parts, and so on) that are expected. Is Replacing Carpet A Capital Expense.

From www.youtube.com

New customer was thinking about replacing her carpets🤯 YouTube Is Replacing Carpet A Capital Expense Web replacing broken or worn out parts with comparable parts. A unit of property is improved if. If a laptop screen is damaged but can be replaced. Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. Web it indicates that recurring activities (inspection, cleaning, testing, replacing parts, and so on) that are expected to be. As. Is Replacing Carpet A Capital Expense.

From aadvancedcarpetcleaning.com

When to Get Carpet Repair Vs. Carpet Replacement? Is Replacing Carpet A Capital Expense A unit of property is improved if. Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. Web replacing broken or worn out parts with comparable parts. Web there is a tax rule that replacing an asset in its entirety is capital expenditure. As with the 2011 regulations, the final regulations provide a general framework for distinguishing. Is Replacing Carpet A Capital Expense.

From www.educba.com

Capitalizing vs Expensing Top 4 Differences to Learn Is Replacing Carpet A Capital Expense Taxpayers generally must capitalize amounts paid to improve a unit of property. A unit of property is improved if. Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. Web replacing broken or worn out parts with comparable parts. Web it indicates that recurring activities (inspection, cleaning, testing, replacing parts, and so on) that are expected to. Is Replacing Carpet A Capital Expense.

From www.vecteezy.com

Capital expenditures or CapEx are a company long term expenses while Is Replacing Carpet A Capital Expense Web there is a tax rule that replacing an asset in its entirety is capital expenditure. If a laptop screen is damaged but can be replaced. Web replacing broken or worn out parts with comparable parts. Taxpayers generally must capitalize amounts paid to improve a unit of property. Web it indicates that recurring activities (inspection, cleaning, testing, replacing parts, and. Is Replacing Carpet A Capital Expense.

From www.trendir.com

Home Renovations You Really Shouldn't Do Yourself Is Replacing Carpet A Capital Expense Web hmrc use ‘capital expenditure’ and ‘enhancements’ interchangeably when referring to capital gains. If a laptop screen is damaged but can be replaced. As with the 2011 regulations, the final regulations provide a general framework for distinguishing capital and. Web there is a tax rule that replacing an asset in its entirety is capital expenditure. Web it indicates that recurring. Is Replacing Carpet A Capital Expense.